The Ultimate Guide To Financial Advisor

Wiki Article

The Single Strategy To Use For Planner

Table of Contents4 Easy Facts About Financial Advisor ExplainedAdvisor Things To Know Before You Get ThisNot known Incorrect Statements About 401(k) Rollovers

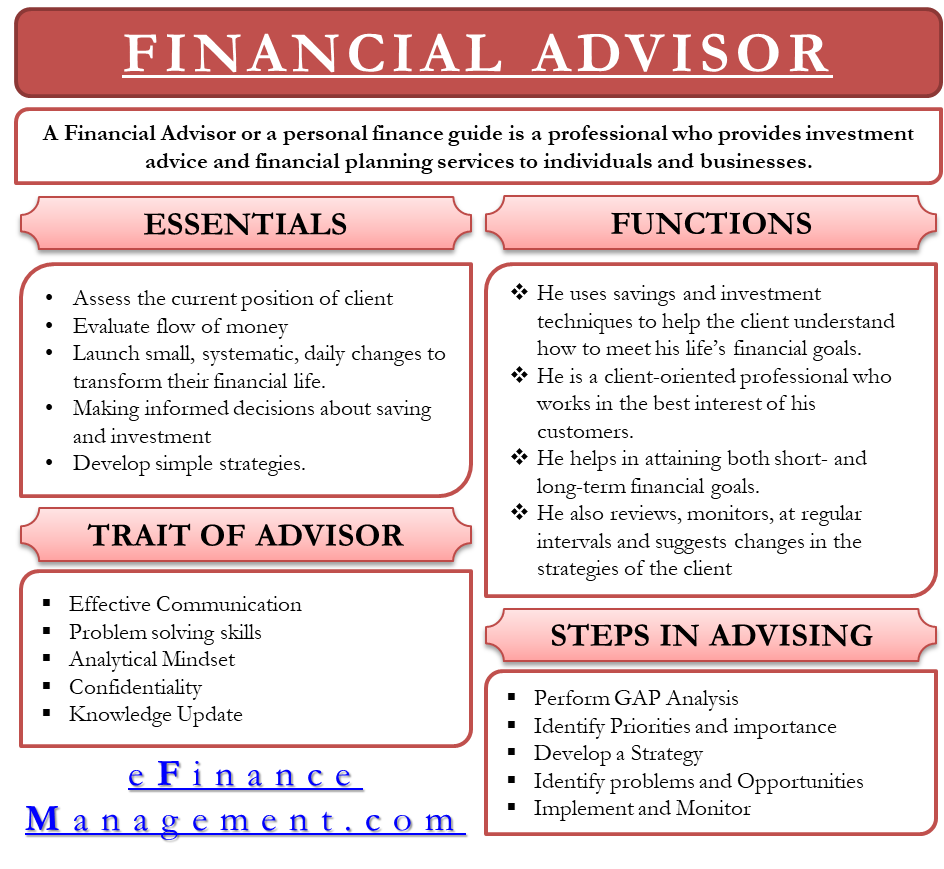

A monetary advisor serves as a trusted consultant and overview, using their expertise and also expertise of monetary markets to establish individualized monetary plans and also strategies that satisfy each client's unique demands and goals. They function to aid their customers attain a secure monetary future and safety as well as aid them navigate complicated economic choices and challenges.

Not known Details About 529 Plans

A monetary advisor can aid you attend to as well as manage any superior debts and create an approach to come to be debt-free. An economic expert can assist you intend to distribute your assets after your death, including developing a will and establishing counts on. A monetary expert can aid you comprehend as well as manage the threats connected with your monetary circumstance and also investments - 401(k) Rollovers.

A monetary consultant can assist clients in making investment decisions in several ways: Financial experts will certainly collaborate with clients to comprehend their threat resistance and also develop a customized financial investment method that aligns with their goals and comfort level. Advisors generally recommend a varied profile of investments, including stocks, bonds, as well as other possessions, to assist reduce threat as well as maximize possible returns.

Financial advisors have considerable expertise and also competence in the financial markets, as well as they can help customers recognize the potential advantages and also threats related to different financial investment alternatives. Financial consultants will on a regular basis review clients' portfolios and also make referrals for changes to guarantee they remain straightened with clients' objectives as well as the present market problems (529 Plans).

How Advisor can Save You Time, Stress, and Money.

Yes, a monetary advisor can help with financial obligation management. Financial debt management is essential to total financial preparation, and economic experts can supply advice as well as support in this area.

These designations show that the consultant has completed extensive training as well as passed tests in monetary planning, investment management, as well as other pertinent areas. Seek economic consultants with several years experience in the economic services sector. Advisors who have remained in the field for a lengthy time are most likely to have a deeper understanding of the financial markets as well as financial investment methods and may be much better equipped to deal with intricate monetary situations.Ask the financial advisor for references from current or previous clients. Financial experts usually get paid in among a number of means: Some economic experts make a payment for offering monetary items, such as shared funds, insurance policy items, or annuities. In these instances, the consultant gains a percentage of the item's list price. Various other economic experts work with a fee-based design, charging a charge for their advice as well as solutions. Some economic experts function for banks, such as banks or broker agent firms, and also are paid an income. In summary, economic advisors earn money on a payment, fee-based, as well as wage. Here are methods to discover a reliable monetary consultant: Ask buddies, family members, or associates for references to monetary experts they trust and also have worked with. When you have a checklist of possible experts, research study their histories and credentials. Check if they have any corrective background or grievances with governing firms, such as the Financial Industry Regulatory Authority (FINRA) or the Stocks as well as Exchange Compensation (SEC). Schedule a meeting or consultation with each consultant to discuss your monetary objectives as well as to ask questions concerning their experience, investment philosophy, and settlement design. Confirm that the economic expert has the appropriate licenses and certifications, such as a Qualified Economic Coordinator(CFP)classification or a Series 7 certificate. Choose a consultant you feel comfortable with as well as depend on to handle your her comment is here financial resources. It's necessary to locate a consultant who pays attention to your needs, comprehends your monetary circumstance, and also has a tested record helpful customers achieve their monetary objectives. Nevertheless, collaborating with a monetary advisor can be highly valuable for some people, as they can provide important expertise, assistance, and support in handling financial resources and making financial investment choices. Furthermore, an economic consultant can aid develop a detailed monetary plan, make recommendations for investments and take the chance of management, and provide recurring assistance and also checking to assist make certain clients reach their economic objectives. In addition, some individuals may like to do their research and also make their own financial investment decisions, as well as for these individuals , paying a financial expert may not be essential. A licensed financial investment advisor(RIA )is a specialist that supplies financial investment recommendations and also manages client profiles. They are signed up with the Stocks and Exchange Commission (SEC )or a state securities regulatory authority. This can consist of budgeting, financial obligation monitoring, insurance policies, and also financial investment schemes all to enhance their customers'total riches.

Report this wiki page